Issues

The complexity of

invoice collection tracking

- Bank transfers, which are not instantaneous and difficult to trace from bank tools

- Customer-controlled payment terms, generally within 30 days

Impacts

Solution

A unified collection account,

real time and connected

Discover how CentralPay meets your challenges

Account checking

The CentralPay account displays a real-time balance. It enables customer transfers collection, and instantly notifies the finance team, so they no longer have to consult it regularly.

Invoice reconciliation

Each customer profile in the ERP system is assigned a different virtual IBAN. Invoices issued in this way feature these dedicated IBANs, enabling CentralPay to identify and automatically reconcile incoming payments with the correct customer.

ERP update

As soon as a payment is received, the CentralPay account updates the invoice payment status in the ERP system in real time via API or CSV files. This allows the finance team to focus their efforts on checking and validating pre-reconciliated transactions.

In addition

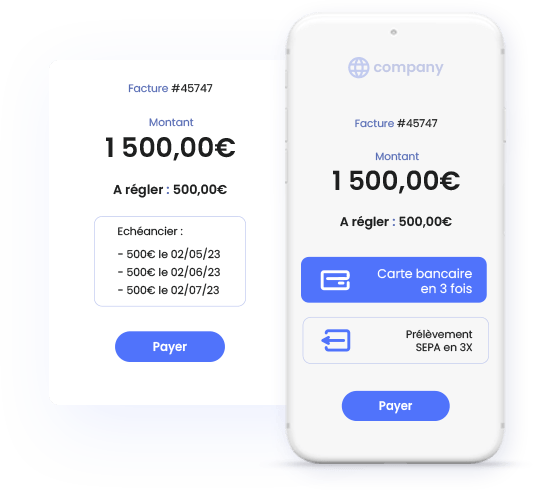

Installment invoice collection

Some invoices need to be paid in installments to suit the company’s invoicing model or the customer’s cash flow.

With CentralPay invoice collection solution, finance teams can send a payment link by email, SMS or integrate it by QR Code on invoices. This payment link enables you to set up installments by credit card or SEPA direct debit. It optimizes the customer payment process by digitalizing card data collection and SEPA mandate signature.

How does CentralPay help you collect your invoice payments?

The CentralPay solution has enabled us to collect and reconcile our invoices easily, while offering our customers a smooth payment process.

The CentralPay teams were very responsive and quick to adapt their platform to our needs.

Matthieu Philippe

Digital project manager – Digital strategy

Frequently asked questions

Learn all about the CentralPay invoice collection solution

The solution is made for all companies receiving customer payments by SEPA bank transfer and wish to automate these payments processing. This, in order to optimize their cash flow and related operational costs.

We also work with invoicing software, invoice dematerialization operators and accounting software that wish to offer integrated payment services to their users.

The solution is accessible to all entities registered in the European Economic Area, and can accept payments by SEPA bank transfers and SEPA direct debits in Euros, as well as payments by bank card in various currencies.

Yes, the solution also meets a number of e-reporting challenges linked to electronic invoicing regulations:

- Process payment reconciliations within mandatory deadlines

- Transmit payment statuses to dematerialization platforms

- Provide full traceability of payments, even in the absence of transfer references

We are able to exchange data with all the major ERP systems on the market, as well as with in-house designed ERP. The connection can be developed via API or via recurring delivery of CSV files on a SFTP server.