What is Bank Reconciliation?

Bank reconciliation is an accounting control process that involves comparing the entries in the general ledger with the bank statement. The objective is simple: to ensure that the accounting balance matches the bank balance on a given date.

Each line of the bank statement must be linked to an accounting entry. This involves reconciling the entries and then preparing a reconciliation statement that formalizes the agreement between the two sources.

This control is not mandatory, but remains a common practice in businesses to ensure the accuracy of monthly closings and guarantee the reliability of their cash flow.

Why reconcile transaction entries?

In accounting, account 512 – Bank records all transactions: incoming transfers, supplier payments, bank charges, and checks cashed or pending. It reflects the company’s actual financial situation at a given point in time.

However, the balance of account 512 does not always match the bank statement balance, and for good reason: the two systems do not operate at the same pace. A check issued may take several days to clear, a transfer may not appear until the next day, and a direct debit may be rejected without the entry being corrected.

These time lags are normal, but they can distort cash flow monitoring if they are not controlled.

Bank reconciliation allows you to verify the consistency between accounting entries and the transactions actually recorded at the bank.

How does this differ from bookkeeping?

Accounting reconciliation involves assigning a unique code to multiple entries that relate to the same transaction.

For example, a customer invoice paid in three installments will have the same payment method on each line item. The benefit? The ability to quickly identify invoices that are fully paid and those that remain partially paid. This is a method for tracking subsidiary accounts, primarily customer (411) and supplier (401) accounts, to ensure that each transaction is properly settled.

Bank reconciliation, on the other hand, doesn’t verify whether an invoice has been paid, but rather whether the money has actually been deposited into or withdrawn from the bank account.

These two practices are therefore complementary:

- Reconciliation guarantees that recorded payments actually appear on the bank statement.

- Reconciliation guarantees that recorded payments actually appear on the bank statement.

What are the steps involved in bank reconciliation?

Bank reconciliation is performed periodically, often at the end of the month, sometimes continuously depending on the methods and tools used. Here’s how it works.

1. Gather the necessary documents

Bank statements, account 512 extracts, previous reconciliation statements, proof of payments or receipts… all these elements serve as the basis for the verification.

2. Verify the opening balance

The opening balance of the account must match the closing balance of the last reconciliation. This is a simple but essential step to avoid any calculation errors.

3. Reconcile accounting entries

Each bank account transaction is reconciled with its corresponding accounting entry. This verification helps identify unreconciled entries: payments not debited, receipts not recorded, forgotten bank fees, etc.

4. Prepare the bank reconciliation statement

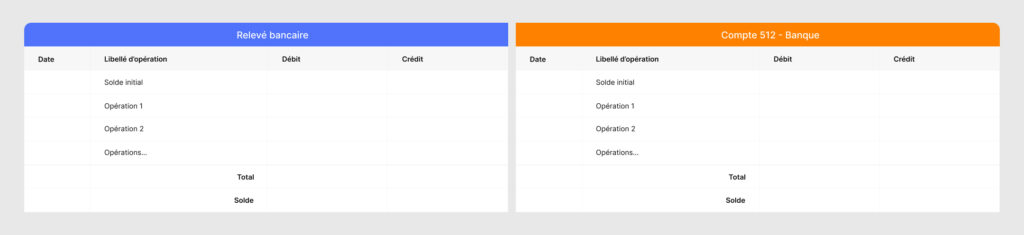

This is done using two tables:

- Transactions present in the accounting records but absent from the bank statement (e.g., check issued, scheduled transfer)

- Transactions visible on the bank statement but not yet recorded (e.g., overdraft fees, bank charges, customer payments)

From these two lists, a theoretical bank balance is calculated; in other words, the account balance after all transactions have been reconciled. This is then compared to the accounting balance:

- If they match, the reconciliation is balanced.

- Otherwise, the cause must be identified: a data entry error, a missing entry, or simply a date discrepancy.

5. Reconcile discrepancies

Missing transactions are recorded, errors corrected, and duplicates removed. At the end of the process, the balance of account 512 must exactly match that of the bank statement.

The bank reconciliation statement can then be generated: it lists the reconciled transactions, those still pending, and serves as proof of internal control.

Which bank reconciliation tool should you use?

There is no single right way to perform a bank reconciliation. It depends primarily on the company’s organization, its accounting maturity, the volume of cash receipts to be processed, and the desired level of automation. Here is an overview of the most commonly used solutions.

Excel Spreadsheets

A universal and easy-to-use tool, Excel allows you to create your own tracking spreadsheets and customize your method. This manual reconciliation approach is suitable for small organizations or for testing a process before automating it. However, as soon as volumes increase, the risk of errors (duplicates, omissions, manual data entry, etc.) rises, impacting collaboration.

Accounting softwares

Accounting software often allows users to import statements, reconcile entries, generate bank reconciliation reports, and sometimes even automatically create bank expense entries. These are robust solutions for managing the month-end closing process.

However, these tools remain focused on accounting: they don’t always update cash flow in real time. Bank reconciliation is therefore performed after the fact, once the bank transactions have been processed.

ERP

The leading ERP systems on the market (Cegid, Sage, EBP, etc.) include native reconciliation modules capable of centralizing all accounting, banking, and cash flow data in a single environment, more or less automatically. This integration facilitates the reconciliation of cash flows and, more broadly, financial controls and audits, thanks to a consolidated and consistent view of transactions.

On the other hand, the initial setup can be complex, and flexibility remains limited. These solutions are ideal for companies that want to automate their processes on a large scale, but less suitable for occasional, evolving needs or those requiring quick adjustments.

Payment Service Providers

PSPs process companies’ incoming cash flows. Some develop innovative mechanisms that link each payment to the invoice, customer, or relevant sales channel. This information is then automatically transmitted to the accounting system or ERP to prepare for the reconciliation between the entries and the funds actually received.

This is a pre-reconciliation approach, which requires sufficient digital maturity to fully realize its potential.

Accelerate your bank reconciliation with CentralPay

With CentralPay, bank reconciliation is no longer done at the end of the month, but at the moment of payment.

The platform integrates B2B payment workflows, where each transaction is enriched with information/supporting documents useful for reconciliation: invoice reference, customer ID, standardized description, proof of payment, etc.

This information is then transmitted to the ERP to facilitate matching with entries in account 512, while ensuring reliable real-time cash flow monitoring. The results? Bank and accounting balances converge, discrepancies are identified immediately, and the general ledger remains up-to-date.

For whom?

- E-commerce businesses and B2B marketplaces with multiple payment flows (cards, transfers, SEPA) and complex commission management

- Mid-sized or small businesses with high transaction volumes, requiring detailed reconciliation by order, customer, or sales channel

- Multi-entity groups seeking a consistent, automated, and traceable process

In practical terms, CentralPay simplifies payment collection regardless of the sales funnel and pre-reconciles transactions before they are even imported into the ERP. Fewer oversights, fewer data entry errors, fewer accounting anomalies: entries are reconciled earlier, bank reconciliations are faster, and teams save valuable time.