What is a bank transfer ?

A bank transfer is the transfer of funds from one bank account to another. This payment method is carried out electronically between two banks, following the issuance of a transfer order by the payer.

Types of payments transfers

There are several categories of transfers, depending on their purpose and method of execution.

According to frequency:

- One-off transfer: Transfer of funds made following a transfer order for a specific transaction, on a given date.

- Standing order: Recurring transfer executed at regular intervals (daily, monthly, annually, etc.) for recurring payments such as subscriptions or split payments.

Depending on the geographic area:

- Domestic bank transfer: Transfer made between two accounts located within the same country.

- SEPA bank transfer : A transfer made in euros between two accounts located within the European Economic Area. The SEPA transfer has enabled the European Union to simplify and harmonize all transfers made within the zone.

- International bank transfer: A transfer of funds between two accounts located outside the SEPA zone, usually in a foreign currency.

SWIFT is the main network for the exchange of international financial flows, with most banks and financial institutions members.

Depending on the date of transfer of funds :

- Immediate transfer : This is the most traditional form of bank transfer, where the transfer order is executed as soon as it is validated by the sender. The funds are captured and then transmitted during the next bank transfer. It then takes 1 or 2 business days for the funds to be available in the beneficiary’s account.

- Instant transfer : A transfer executed instantly between two accounts within the SEPA zone. Unlike a traditional SEPA transfer, funds are available in less than 10 seconds, regardless of the day or time. Whether or not an instant transfer is used depends primarily on the originating bank, which may or may not offer this service.

- Deferred transfer : Transfer of funds whose transfer order is programmed in advance by the sender, for a future date.

Depending on the account to which the funds are transferred:

- Internal transfer : Transfer made between two accounts located in the same bank (e.g.: transfer of funds to a savings account, transfer between a payer and a beneficiary who are customers of the same bank, etc.)

- External transfer : Transfer made between two accounts located in separate banks.

Fees associated with a payment by transfer

Banks generally charge fees for each wire transfer transaction. These fees vary depending on the type of transfer, whether it’s a one-time or standing order, or the area where it’s being processed, for example (France, SEPA zone, or international). Note that international wire transfers are generally more expensive due to the issuing commissions and exchange rate fees applied.

It is recommended to find out in advance about the pricing charged by your banking establishment, in order to assess the costs associated with receiving transfers for the specific needs of your business.

How does a transfer payment work ?

Behind a bank transfer payment, there are various actors, interactions and jargon that need to be mastered to understand the market.

The different actors in the process

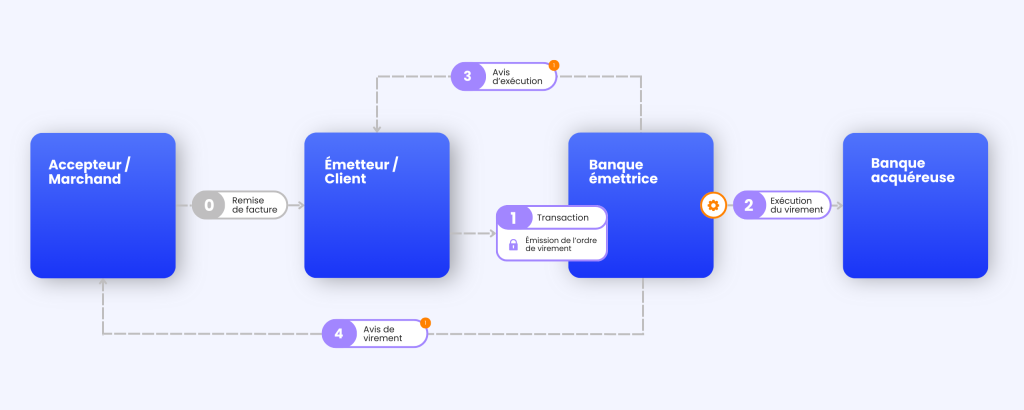

The transfer process involves four main players:

- Issuer : The customer who makes the payment by transfer.

- Issuing Bank: The financial institution, usually the customer’s bank, that executes the transfer order and transfers the funds.

- Acceptor: Any merchant or commercial entity that accepts payment by wire transfer.

- Acquiring Bank: The financial institution, generally the merchant’s bank, which allows the merchant to acquire, process and deposit funds received by transfer as well as maintain accounts.

Processing of payment by transfer

A payment by transfer is made according to a specific route :

- Transaction initiation : After receiving the invoice, the customer goes to their banking account to issue a transfer order. They select their beneficiary (IBAN) and enter the necessary information (amount, date, immediate or instantaneous, etc.). Upon validation, they check the order information one last time and authenticate themselves to validate their identity.

- Exécution du virement : Une fois l’ordre de virement réceptionné par la banque émettrice, celle-ci vérifie les fonds disponibles sur le compte du client.

- If the latter has the necessary funds, it captures them and transfers them to the acquiring bank. The funds are transferred during the next bank session. The funds are available within 2 business days.

- Otherwise, the latter refuses to execute the bank transfer.

- Sending a confirmation of execution : The issuing bank informs the sending customer that the transfer has been successfully completed.

- Sending a transfer notice : The issuing bank alerts the accepting merchant that a customer transfer will soon be delivered to them.

Services associated with bank transfers

In recent years, transfers have continued to evolve, meeting the varied needs of merchants and payers.

Some examples:

- Automation services : Service allowing you to schedule and automate the sending of transfer requests, customer notifications and employee alerts (reception, error, etc.) for example, in order to simplify communication related to the processing of transfers.

- Virtual IBANs : A service that allows you to generate an infinite number of virtual IBANs and associate them with different objects (invoices, customers, points of sale, etc.). Thus, when receiving a transfer, the merchant is able to identify the sender and automatically reconcile the invoice, based on the virtual IBAN used during payment.

- Initiated Transfers (PIS) : A new type of transfer, where the merchant initiates the transfer. The merchant sends a transfer request to a customer directly in their banking application. The merchant enters the amount, IBAN, and references on behalf of the customer, so that all they have to do is validate the transfer.

Security of payment by transfer

Despite a relatively low wire transfer fraud rate (0.001%) due to the low volume of transactions, the amounts defrauded by wire transfer continue to increase (€313 million in 2022²), particularly in the professional context. 64% of French companies report having been victims of at least one attempted bank transfer fraud in 2023³.

The Banque de France is taking these figures very seriously, intensifying its fight against fraud across the country. Measures include requiring banking institutions to implement double-validation procedures for transfers, mandatory authentication of beneficiaries, and increased awareness-raising efforts.

Today, payment by bank transfer remains a secure method of transferring funds, especially when good security and prevention practices are applied.

Advantages and disadvantages of paying by transfer

| Benefits | Disadvantages |

| Irrevocable : Once the transfer has been executed, the customer can hardly contest it (due to double validation) | Little control : Payment method initiated by payers which can cause payment delays or errors (amounts, references, etc.) |

| Speed : Funds available within two working days for standard transfers and immediately for instant transfers | Reconciliation : Manual processing of the accounting reconciliation between the funds received and the invoice in question |

| Costs : Transfers involve transaction fees, charged by the bank, which are often significantly lower than bank card fees. | Customer experience : Disruption in the “Order-to-Cash” journey caused by the transfer being made on the customer’s banking interface, and not on the online payment page |

| Suitable for B2B : Preferred payment method for professionals, particularly for large baskets | |

| Guaranteed : The transfer is only made if the customer has the necessary funds in their account | |

| Solvency : Possibility of receiving regular transfers, in advance | |

| Secure : Following the issuance of a transfer order, funds are directly transferred from account to account, without third-party intervention. | |

| Geographic area : Bank transfers are possible, anywhere in the world, in any currency |

The coming years will be marked by the democratization of instant transfer payments, driven in particular by the update of European Regulation 2024/884. Currently representing 7.8% of European transfers⁴, what will their share be in 3, 5, or 10 years?