A seemingly free bank transfer

The SEPA credit transfer is now the standard payment method in Europe. It allows funds in euros to be transferred from one bank account to another within member countries.

Reliable, traceable, and irrevocable, it works with all banking institutions (Société Générale, BPCE, BNP Paribas, etc.). Within one to two business days, or even within seconds for instant transfers, the funds are credited to the beneficiary’s account.

Reliable, traceable, and irrevocable, it works with all banking institutions (Société Générale, BPCE, BNP Paribas, etc.). Within one to two business days, or even within seconds for instant transfers, the funds are credited to the beneficiary’s account.

Why is receiving a bank transfer expensive for businesses?

Receiving a transfer isn’t simply an automatic credit to the recipient’s account. The recipient’s account must be identified, reconciled, and accounted for, often manually. These operations are repeated with each payment, involve multiple departments (finance, accounting, sales administration), and ultimately represent a significant hidden expense.

Identify the transfer received

When an originator makes a transfer, they enter the information themselves: transfer description, amount, invoice reference, etc. This data is rarely standardized. Some French banks truncate the descriptions, while others modify the format of sender names or display only a partial reference.

Result: companies receive unidentified or partially completed bank transfers every day. You must then:

- Compare the amounts with open invoices,

- Search for correspondences in ERP or Excel files,

- Contact customers to confirm the source of payment,

- Or sometimes check the IBAN or BIC to identify the account holder.

Manage errors and anomalies

Even when properly completed, a transfer can cause problems:

- Inaccurate amount (overpayment or underpayment)

- Missing or incorrect reference

- Beneficiary account or description error

In these cases, accounting teams must perform cross-checks: contact the customer, issue a credit note, or initiate a refund transfer. Each action adds additional delays and creates the risk of accounting errors.

These anomalies are not uncommon: in a B2B context, where customers often pay on time (30, 45, or 60 days), transfer errors can represent up to 10% of monthly collections, depending on the volume and diversity of customer accounts. These corrections and reminders further increase the cost of a traditional bank transfer and slow down payment recognition.

Reconcile and post payments

Once identified, the transfer must be manually matched with the relevant invoice:

- Download the bank statement file

- Import into the ERP or accounting software

- Enter the corresponding invoice number

- Validate the allocation

- Archive the transfer proof (credit advice, PDF receipt, screenshot, etc.)

Each unreconciled or incorrectly identified transfer delays the accounting recognition of the payment. The amount is credited to the account, but not recognized in the receivables balance: the company thinks it has been paid, but its management system still indicates an open invoice.

Consequences:

- Unnecessary reminders are sent to customers, damaging the business relationship.

- Cash flow forecasts become inaccurate.

- DSO increases unnecessarily.

- And finance teams waste time correcting discrepancies.

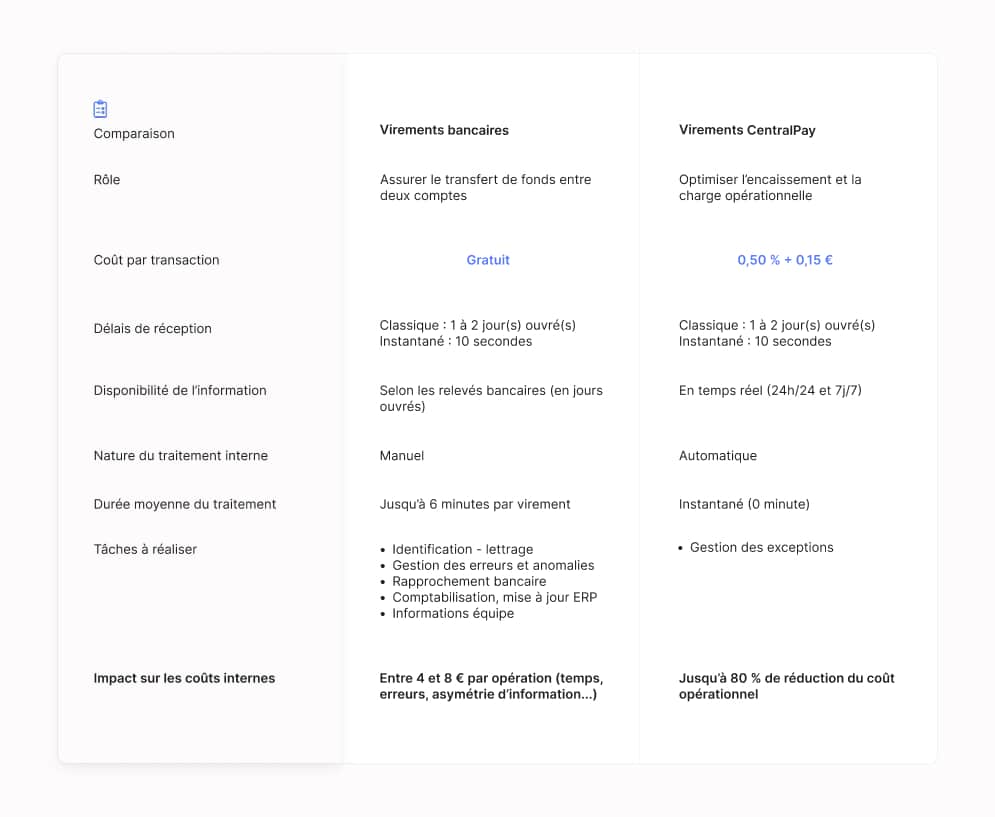

This work takes several minutes per transfer. Multiply this time by several hundred monthly payments, and you get several hours of administrative processing per week. It is estimated that manually processing an incoming transfer represents between €4 and €8 per transaction¹, taking into account the time spent, the risk of error, and inter-departmental information asymmetries. This hidden cost becomes significant as the volume of payments increases.

CentralPay transfers, an alternative that eliminates hidden costs

Since the Instant Payment Regulation, traditional banking institutions have been promoting the free nature of SEPA transfers, and it’s true: they no longer charge for sending or receiving. But this free service only covers interbank execution, not the operational management it involves on the company side. It is precisely this difference that makes the cost of a bank transfer a productivity issue for businesses.

CentralPay rethinks bank transfers as an automated, traceable, and real-time reconciled flow.

A more fluid transfer, better integrated into modern practices

CentralPay does not replace bank transfers: it optimizes their experience and management. The solution helps customers make transfers more easily, whether instant or standard, by leveraging SEPA standards and/or Open Banking technologies (in the case of Pay by Bank).

Whether the payment is initiated from an e-commerce website, a professional portal, or an email payment link, completing the transfer becomes a seamless and modern experience, perfectly suited to B2B uses.

A seamless experience for both the customer and the financial sector

Where traditional bank transfers still require manual operations, CentralPay automates the entire collection process. Each payment received is identified and instantly matched with the corresponding invoice or order, thanks to a configurable rules engine, virtual IBANs, and unique references.

Posting and status updates are then automatically performed in the company’s ERP or information system. This process transforms an often manual and sequential flow into a continuous, traceable, and integrated process, with no changes for the end customer.

Measurable savings

By eliminating repetitive tasks related to the manual processing of bank transfers, CentralPay allows finance teams to save time, reduce hidden costs, and improve the reliability of collections.

The effects are tangible:

- DSO reduction of several days,

- Increased productivity in payment tracking and reconciliation,

- Better visibility of cash flow in real time.

SEPA transfers remain a pillar of payments in Europe. But free on paper doesn’t mean cost-free: each transfer received hides a lengthy processing time, multiple validations, and productivity losses.

Banks have eliminated their visible fees, but not the operational friction they impose on their customers. By automating these processes, CentralPay transforms bank transfers into a truly optimized payment method, reducing hidden costs, accelerating collections, and improving visibility of flows.

In short, paying a little… to save a lot and finally controlling the cost of a bank transfer.

¹ CentralPay internal data (2025)