Why is Apple Pay so popular with users (and merchants)?

One in two Europeans owns an iPhone³. This widespread adoption has created a natural habit: if

Apple Pay is based on a three-pronged promise: ease of use, built-in security, and compliance with European requirements.

Biometric authentication (Face ID or Touch ID) is coupled with tokenization and encryption via the Secure Element chip. A mechanism that fulfills the same function as 3DS 2.0 while respecting the requirements of Strong Customer Authentication (SCA), supported by PSD2.

Result: an acceptance rate exceeding 98%⁴, a very low fraud rate, and a deeply ingrained usage habit among users.

On desktop, this fluidity is still rare. But for merchants, limiting themselves to mobile only would mean leaving out a significant portion of transactions, coming from more sedentary users.

🔎 Did you know?

Unlike cards saved in a browser, Apple Pay never transmits your actual card details. Each transaction relies on a unique token (Device Account Number) and a dynamic cryptogram, which is biometrically verified by the user.

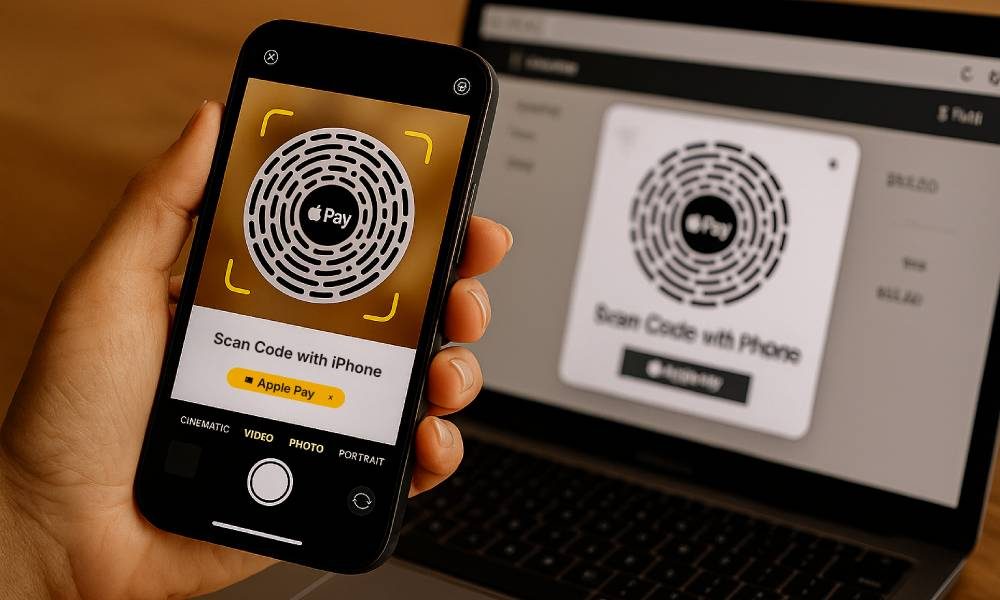

How does Apple Pay work via QR code?

Originally designed for mobile-only use, Apple Pay is now opening up to desktop thanks to a cross-device journey accessible from any computer or tablet, even outside the Apple ecosystem, thanks to the display of a QR Code.

The principle remains very simple:

- The user selects the checkout option with Apple Pay,

- A QR code appears on the screen,

- They scan it with their iPhone and confirm the transaction via Touch or Face ID.

From a business perspective, the benefit is immediate: with Apple Pay via QR code, merchants can now simplify the purchasing process for Apple users buying from a computer. This is often associated with higher basket sizes (travel, equipment, appliances, etc.) but also with professional profiles or those accustomed to the convenience of desktop computers.

How to integrate Apple Pay into your sales funnel?

Integrating Apple Pay JS or Apple Pay via QR Code on desktop can be relatively technical, but native integrations in some PSPs offer much faster deployment.

To guarantee an optimal experience, the merchant must:

- Dynamically detect Apple Pay availability based on device and browser,

- Provide a seamless fallback to another payment method if Apple Pay is unavailable (e.g., Google Pay, card, instant transfer),

- Orchestrate checkout by device to prioritize methods with high acceptance rates.

Apple Pay must therefore be integrated into an intelligent routing strategy, just like competing cards, instant transfers, or digital wallets.

Google Pay: A credible alternative?

Google Pay, which became Google Wallet in most markets in 2024, offers a similar approach: web integration, tokenization, biometric authentication, and strong compatibility with the Android ecosystem and the Chrome browser, widely used on desktop.

With nearly 250 million users in over 90 countries⁵, the online payment solution covers a large audience, complementing iOS.

From an user experience perspective, Google Wallet is a solid alternative. However, a few specific features make the experience less seamless than Apple Pay:

- The display varies significantly depending on the mobile phone brand, Android version, and browser used,

- Some features, such as biometric authentication, are not always enabled,

- Web integration often requires more testing to cover specific Android/Chrome scenarios.

Towards a truly seamless cross-device payment experience?

With the latest developments in iOS, Apple is gradually evolving its wallet into a truly cross-functional payment module, capable of accompanying the user on all their devices and in all their uses (one-off and recurring, online and in store…).

Recent developments include:

- Pre-authorized payments: a single initial biometric validation then enables recurring transactions. A key advantage for subscription models

- Using the Carte Bancaire (CB) network via Apple Pay: some French cards can now be routed through the CB network, allowing merchants to benefit from more competitive acceptance fees than Visa and Mastercard.

- CDCVM (Consumer Device Cardholder Verification Method): This native identification method via Face ID or Touch ID now allows contactless payments beyond the usual limits on compatible terminals in stores.

- Passkeys and passwordless authentication: Integrated within the Apple ecosystem, they allow users to log in and pay using biometrics, without any identifier. A solution that addresses both user experience and phishing.

By bringing Apple Pay to payment via QR Code, Apple further enhances the simplicity of the desktop shopping experience, which remains one of the most effective levers for transforming a purchase intention into a real transaction.

¹ PYMNTS, Apple Pay’s 10-Year Journey and Its Next Decade of Decisions (2024)

² Statcounter, Desktop vs mobile vs tablet marketshare worldwide (2025)

³ Statista, Apple Pay adoption in USA (2025)

⁴ Gr4vy, Optimizing payments for mobile wallets: Apple Pay, Google Pay, etc. (2025)

⁵ PYMNTS, Google Wallet Expands Availability of Age and Identity Features (2025)

Image generated by artificial intelligence