What is an American Express card?

Born from the merger of three financial companies (Wells, Fargo and Butterfield), American Express Company was initially a company specialising in money transfers. In 1891, AMEX became a pioneer in the field of business payments with its Travellers Cheques, designed to facilitate transactions for American citizens abroad.

With the issuance of its first payment card in 1958, American Express entered the card scheme market, conquering the North American market before expanding into Europe in the 1960s. Over the next four decades, AMEX continued to introduce innovative services, helping to define its high-end positioning.

The American Express card is independent of the cardholder’s bank. It is a true deferred debit card, with the cardholder’s bank account used to repay the amounts spent with the card during the previous month. An AMEX card does not impose a predefined spending limit, which varies according to several factors specific to the cardholder (income, type of card, monthly spending history, etc.).

Who are American Express cardholders?

France has 1.3 million American Express cardholders (2023), a figure that is constantly growing³. Although this is far from the 50 million cardholders in the United States¹, there is nevertheless growing interest in France.

A privileged and/or itinerant clientele

AMEX offers are mainly aimed at two categories of buyers. On the one hand, there are

On the other hand, there are professionals on business trips (1 to 2 nights on average), whose expenses are covered by their company. Business card spending accounts for nearly three-quarters of American Express transaction volumes.

| Did you know? A few years ago, each cardholder had to prove a minimum annual income of €20,000 to obtain a Blue Card (AMEX entry level). This requirement was lifted in November 2022 Currently, there are only three requirements: → Be over 18 years of age → Have a bank account in euros, domiciled in France → Not be listed by the Bank of France |

The financial and non-financial benefits of an AMEX card

American Express offers several payment cards (Blue, Green, Gold, Corporate), each with distinct features and numerous benefits for customers:

Financial benefits:

- No predefined spending limit, but one that can be adjusted based on the cardholder’s income and monthly spending history.

- Card payment facilities, such as interest-free instalment plans or setting up regular payments.

- Fraud insurance, including full reimbursement within 48 hours, free of charge.

Non-financial benefits:

- Internal customer service, available worldwide 24/7

- Insurance in the event of theft/loss, with card replacement within 48 hours, free of charge

- Membership Rewards® loyalty programme: €1 spent = 1 point earned, valid for life at many affiliated merchants.

- Concierge programme: access to airport lounges, invitations to premium events, and more.

- Travel insurance: flight cancellation or delay, baggage delay, medical assistance, car rental cover, and more.

Why should merchants accept American Express payments?

In fact, adding AMEX cards to the range of cards accepted is a strategic and commercial choice that offers many advantages for merchants.

A commercial and strategic opportunity

In its early days, American Express favoured a small network of merchants offering exclusive, high-end services to cardholders in transport (airlines and railways), hospitality (travel agencies, hotel groups and resorts), restaurants (traditional, high-end and gourmet), leisure and culture.

In recent years, AMEX has undergone a major strategic shift, expanding and diversifying its customer base globally. The number of merchants accepting AMEX (online/offline) has naturally increased (+26% in 2022) and the range of services available has multiplied (streaming, local shops, telephony, etc.). Today, there are 73 million American Express merchants worldwide, including more than 45 million outside the United States².

Take advantage of AMEX payments

Affiliated merchants see AMEX as the ideal partner for increasing their revenue by reaching new categories of payers, building customer loyalty and increasing the acceptance rate for card payments.

1. Opening up to a new type of buyer

Accepting American Express cards means accessing a wealthy clientele (senior executives, business travellers, etc.) with high purchasing power. These buyers spend 1.8 times more and have average basket sizes 62% higher than the average⁴. Seeking high-end experiences and services, these customers, whether individuals or professionals, represent a lucrative market for merchants, especially in certain sectors such as tourism and leisure, professional services, luxury goods, etc.

2. Build customer loyalty

Before making a card payment, AMEX users have gotten into the habit of checking whether it is accepted by the merchant in order to accumulate points and loyalty benefits. In France, 76% of AMEX cardholders admit to being more loyal to merchants who accept their card, encouraging them to return regularly. Accepting American Express cards guarantees that these customers will return regularly.

3. Increase the acceptance rate

Unlike other card schemes, transactions made with American Express payment cards have an acceptance rate of nearly 100%. With AMEX, refusals due to insufficient funds, suspected fraud or incorrect or obsolete card information are drastically reduced for several reasons:

- A scalable card limit that reduces the risk of insolvency

- A strong authentication protocol (SafeKey 2) based on 3DS2 requirements, reducing the risk of fraud.

- Continuous verification and updating of AMEX card information.

With such a high acceptance rate, merchants can be sure they won’t miss out on any sales.

How does the AMEX model work?

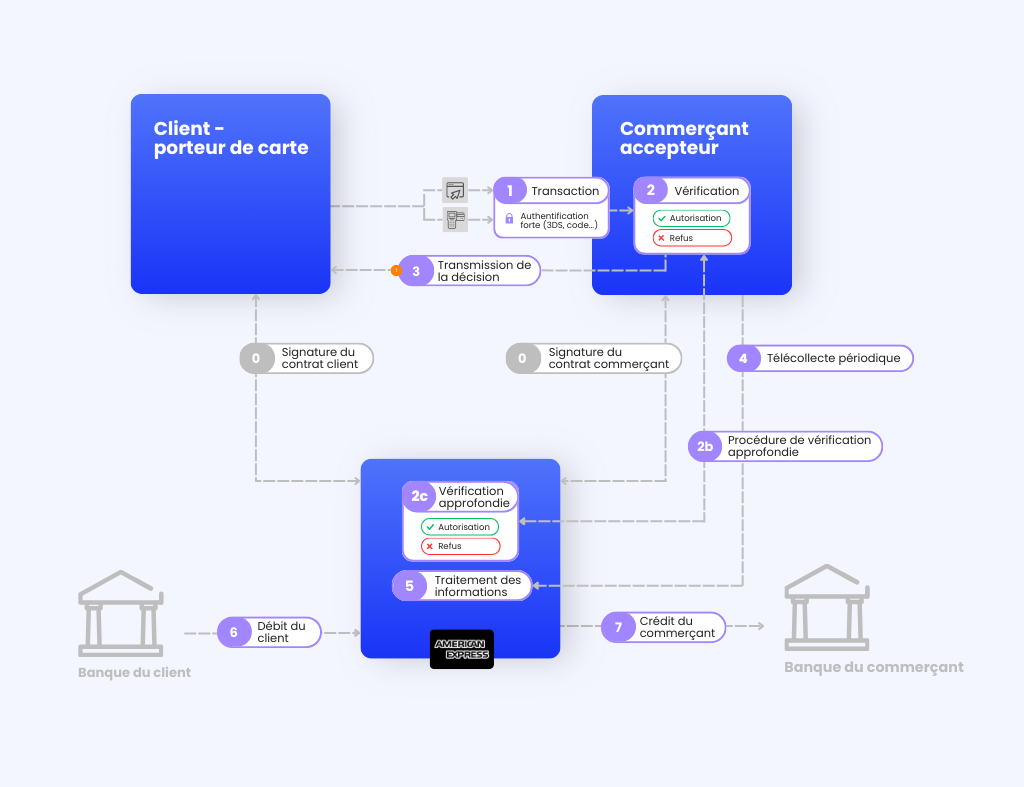

The distinctive feature of the American Express model is its ‘three-cornered’ structure. Unlike Visa, Mastercard or Cartes Bancaires networks, AMEX is both a card issuer and an acquirer, i.e. it is responsible for processing its merchants’ transactions.

The AMEX ‘three-cornered’ model

In this ‘closed’ system, each link in the chain – the payer, AMEX and the merchant – is bound by solid contractual commitments:

- AMEX contract <-> Payer: provision of the card, compliance with the terms and conditions of use, etc.

- AMEX <-> Merchant contract: definition of acceptance request thresholds, provision and operational maintenance of equipment (system, payment terminal), compliance with the terms and conditions of use, etc.

When paying by American Express card, if the amount is below the pre-agreed threshold, the card is automatically accepted. Above this threshold, the merchant sends an authorisation request to AMEX to verify the customer’s creditworthiness. AMEX’s final decision is communicated to the merchant, who then notifies the customer via a notification or receipt.

The merchant sends AMEX the transaction details stored in its system (remote collection), which immediately credits its bank account after deducting its fees and commissions. Then, at the end of the month, AMEX debits the banks of the customers who made these transactions. This information is displayed on the respective account statements of the payers and merchants.

A banking model distinct from that of Visa, Mastercard and Cartes Bancaires

The traditional ‘four-corner’ model operates on the basis of exchanges and cooperation between banks. Unlike AMEX, the card issuer and the acquirer are two separate entities. During a transaction, banking information is systematically analysed (authorised or declined) by the card issuer (Visa, Mastercard and Cartes Bancaires) in order to authorise or decline the payment. The merchant, linked to its acquiring bank by an electronic banking contract, then periodically sends it all the transaction flows carried out by remote collection.

The funds are then transferred directly between the customer’s bank and the merchant’s bank through a clearing process. The transaction is credited to the customer and debited to the merchant, without the involvement of any third party.

How much does American Express payment cost a merchant?

When a customer chooses to pay for their purchases by card, the merchant must pay fees, which vary depending on the type of card (personal, business, debit, credit, etc.), the area where the card was issued (within or outside the European Economic Area) and the card scheme involved in the transaction (CB, Visa, Mastercard, AMEX).

As American Express cards are not issued by banks and are therefore not subject to their fees, their rates can be attractive. In fact, for certain categories of transactions, they are similar to or even lower than other networks (Visa, Mastercard).

Accepting American Express payment cards is therefore particularly advantageous when the merchant’s customer base consists of European professionals or international individuals (British, American, etc.). By authorising AMEX payments, merchants can attract and retain a diverse customer base, while benefiting from competitive fees for distance sales.

American Express, the world’s fourth largest card network behind UnionPay, Visa and Mastercard, is attracting more and more merchants. And with good reason, as accepting AMEX payments is a real lever for boosting sales and increasing revenue.

Ready to accept American Express cards?

¹ American Express – Financial Report Filed to the Securities and Exchange Commission (2022)

² American Express – Partial Financial Report Filed to the Securities and Exchange Commission (2023)

³ Presse-citron – “Which Online Bank Offers an American Express?” (2024)

⁴ American Express – Internal Business Data (2022)

⁵ American Express – Internet Panel Survey (2022)