An alternative to traditional methods?

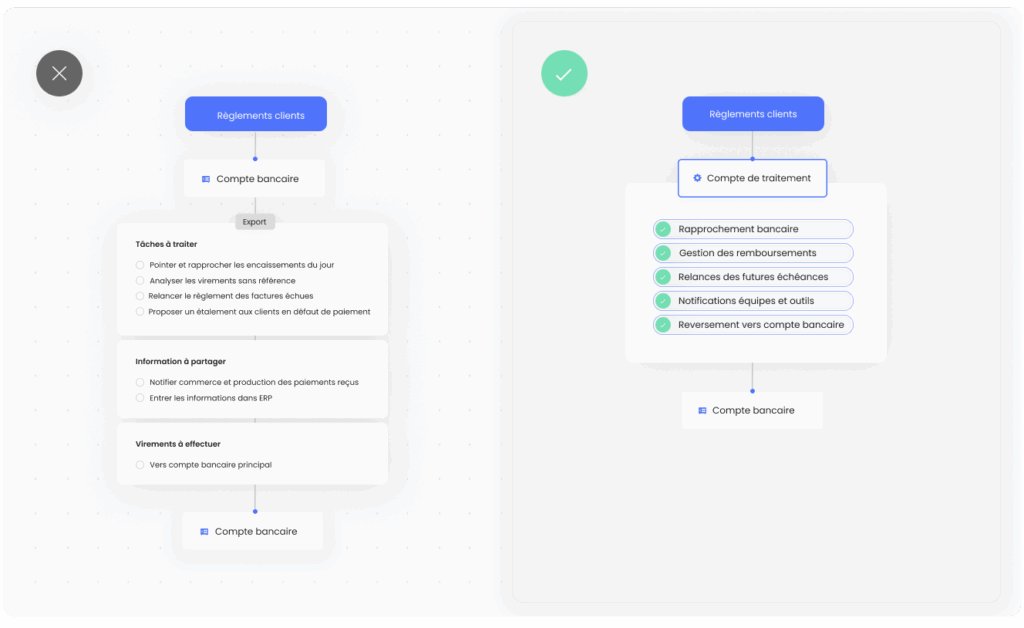

A company’s payments are generally received in one or more bank accounts. It is then up to the finance team to manually record each payment, determine which invoice it corresponds to, verify the amount, process any potential refunds, and then post everything to the accounts.

The traditional approach is to search for and retrieve some of the information from the bank accounts. Some organisations rely on cash flow management tools that are connected to their bank accounts with varying degrees of success. But many continue to consolidate their various bank statements in an Excel file. While these solutions are suitable when applied rigorously and diligently, they become impossible to maintain when volumes increase or the organisation expands its entities and bank accounts.

A new approach involves intervening earlier in the collection cycle, centralising cash flows as soon as they are received in order to automate their processing before they are distributed to bank accounts. This process is based on an account known as a ‘processing account’.

What role does a processing account play?

The processing account is a technical, non-banking account used to receive customer payments and temporarily centralise them before they are processed. The amounts are not necessarily considered as income or cash: they are ‘funds in transit’, awaiting final allocation to a bank account.

Placed upstream of traditional bank accounts, the processing account acts as an operational filter. It receives payments, identifies the issuer, associates them with an invoice or order, processes special cases (deposits, overpayments, grouped payments, duplicates) and consolidates receipts from different payment methods. Once the transactions have been qualified, the amounts are automatically redistributed to the recipient bank accounts.

In other words, this account saves teams from having to interpret flows once they have already been recorded, limiting allocation errors and accounting restatements.

What are the concrete benefits for finance and collections teams?

A processing account consolidates all incoming payments at a single entry point. This paves the way for hyper-automation of payment processing, thanks to the integrated services of the payment platform.

Configurable according to the company’s own automatic rules and supervised by the teams, this processing facilitates the reconciliation of transfers with invoices, the detection of discrepancies, the assisted management of specific cases, the provision of an online space allowing debtors to consult their outstanding balances and make payments, the sending of reminders or targeted notifications, etc.

This approach greatly simplifies the collection cycle. Irregular situations (delays, errors, overpayments, etc.) are identified more quickly, allowing them to be anticipated and dealt with before they become problematic. By classifying flows as soon as they are received, the platform automatically distinguishes between payments that have been acquired, are pending or are disputed, thereby improving the quality of accounting entries and the clarity of available cash flow.

Finally, centralizing payment flows significantly strengthens traceability. Every action is logged, and operations are intelligently linked: a payment and its refund, a transfer and its corresponding invoice, a reminder and the debtor’s status. All this information is accessible at any time from a secure user portal.

This built-in transparency provides a tangible time-saving advantage, both in daily operations and during internal controls or audits.

When does it become a true operational lever?

Using a processing account becomes strategic when managing customer payments represents a significant workload for the company, mobilizing staff, extending processing times, and creating risks in the event of absences or breaks in the validation chain.

It is even more valuable when the company manages multiple bank accounts or entities and wants to consolidate its daily actions within a single channel.

In B2B, it’s common for clients to group several invoices in a single transfer, make partial payments, or pay in installments. Without a dedicated processing mechanism, these complex flows are often misallocated, generating unidentified discrepancies and manual adjustments at the end of the period.

Finally, in business networks and groups, pooling incoming payments into a single bank account often requires manual allocation afterward. The processing account automates this redistribution and ensures clear traceability.

Why is the processing account still relatively unknown?

Although strategic, the use of this type of account remains limited among companies. This can be explained by the legacy of traditional banking practices: historically, incoming payments were managed directly by banks, with no intermediate layer or visibility. This setup has slowed the emergence of complementary solutions capable of structuring payment flows upstream of the bank account.

In addition, this type of account is sometimes perceived as just another technical tool, when in fact it’s a powerful efficiency lever for finance teams. Positioned upstream of accounting systems, it helps structure payments as soon as they arrive, reducing manual workload and minimizing accounting errors.

Contrary to popular belief, this mechanism isn’t limited to large corporations. As soon as a company faces high payment volumes compared to its finance team’s capacity—or deals with non-standardized flows (grouped payments, partial payments, deposits, multi-entity or multi-bank setups)—a processing account becomes an effective way to structure collections and reduce the manual burden of handling them.

The processing account centralizes incoming payments as soon as they are received, automates their processing, and secures the entire collection chain. – Guillaume Ponsard

Why is the processing account becoming a strategic lever?

Several indicators point toward a broader adoption of processing accounts. On one hand, companies are facing a growing need for centralization, traceability, and automation in managing customer payments. On the other, regulatory requirements are tightening: electronic invoicing, e-reporting, reliable audit trails… all of which demand a continuous and documented view of the billing cycle, from invoice issuance to actual payment.

In this context, solutions that structure payment flows upstream of accounting and banking systems are gaining traction. Traditional banking tools—often designed to record transactions rather than qualify them—are showing their limits. At the same time, new specialized services (B2B accounts, processing platforms, management tools) are enabling finance departments to regain control over collections, with measurable gains in quality, processing time, and operational workload.

Does your organization handle complex or non-standard payment flows? Do your teams still spend time manually reconciling discrepancies, overpayments, or unidentified transfers? A processing account could become a key component of your collection chain.